- Value of consolidated production of €73.7 million, up 8.5% compared to 30 June 2022 (€67.9 million)

- Consolidated EBITDA of approximately €11 million

- Consolidated EBIT of approximately €7.5 million

- Consolidated net profit of approximately €3.2 million

Genoa, 27 September 2023 – EdiliziAcrobatica S.p.A. (“EDAC” or the “Group”), the parent of the group of the same name, specialised in construction such as maintenance and renovation of buildings and other architectural structures using double safety ropes, listed on Euronext Growth Milan (ticker symbol EDAC) and on Euronext Growth Paris (ticker symbol ALEAC), announces that the Board of Directors met today and examined and approved the consolidated half-yearly report as at 30 June 2023, prepared in accordance with IAS 34 relating to the interim financial statements of companies listed on non-regulated markets such as Euronext Growth Milan. The financial statements of the previous year were restated according to international accounting standards and a reconciliation between the financial statements of the previous year according to national standards, and the financial statements of the previous year as restated is given in the annex to the interim financial statements.

Anna Marras – Managing Director with responsibility for human resources, to whom the BoD has granted the necessary powers for the management of the company and business continuity – noted: “It is clear that for EdiliziAcrobatica this meeting of the Board of Directors, the first without Riccardo Iovino, is not easy from an emotional point of view. However, we are comforted by the fact that Riccardo himself had already had the opportunity to analyse and appreciate the numbers of the half-yearly report, as the Board of Directors did today. 2023 was marked by the suspension of state subsidies, a decision that had a very strong impact on the construction sector. However, in the case of Acrobatica, as always, this impact resulted in an opportunity to increase the value of production by 8.5 percentage points, which are the result of the commercial strategies which led in the first six months of 2023 to a 50% growth in the number of contracts signed at Group level, of the international expansion and diversification strategies of the company’s business lines that the entire management team has been working on in a continuous manner. This means that the results we expect at the end of the year will allow Acrobatica to continue on its path of growth and expansion laid out by our founder Riccardo Iovino and me”.

MAIN ECONOMIC AND FINANCIAL RESULTS AS AT 30 June 2023

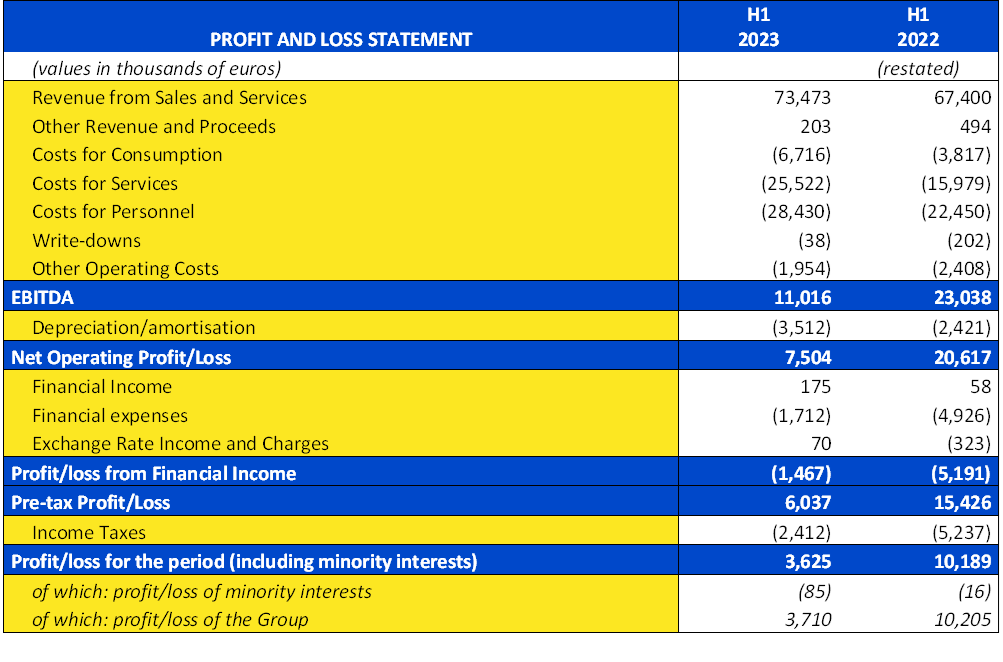

RECLASSIFIED CONSOLIDATED INCOME STATEMENT (in thousands of euros)

| RECLASSIFIED CONSOLIDATED INCOME STATEMENT | 30/06/2023 | 30/06/2022 |

| Operating Revenue | 73,676 | 67,894 |

| Operating Costs | (62,660) | (44,856) |

| EBITDA | 11,016 | 23,038 |

| Depreciation/amortisation | (3,512) | (2,421) |

| EBIT | 7,504 | 20,617 |

| Financial income and charges | (1,467) | (5,191) |

| Profit/(loss) before tax | 6,037 | 15,426 |

| Income taxes | (2,412) | (5,237) |

| Net Result | 3,625 | 10,189 |

| Profit (loss) for the year of minority interests | (85) | (16) |

| Group profit (loss) | 3,710 | 10,205 |

| EBITDA % | 14.95% | 33.93% |

| EBIT % | 10.19% | 30.37% |

| Profit/(loss) before tax % | 8.19% | 22.72% |

| Net Result % | 4.92% | 15.01% |

The data as at 30 June 2023 show an increase in the value of production, from €67.9 million in the first half of 2022 to €73.67 million in the first half of 2023, an increase of about 8.5%, confirming the growth that was already evident at the end of 2022. Worthy of note is the fact that the first half of 2022 was a particularly exceptional period, whose results were beyond expectations thanks to the tax breaks that ended at the end of 2022.

EBITDA amounted to approximately €11 million, with an EBITDA margin of 14.95%, down compared to €23 million in 2022 (EBITDA margin of 33.93%).

Depreciation and amortisation amounted to approximately €3.5 million. This total brought the EBIT to approximately €7.5 million, equal to 10.19% of the value of production, a decrease compared to €20.6 million, equal to 30.37% of the value of production.

The net result for the first six months of 2023 amounted to approximately €3.6 million, equal to approximately 4.92% of the value of production, compared to approximately €10.1 million in the first half of 2022, which as mentioned benefited from the effect of the subsidies, equal to 15.01%.

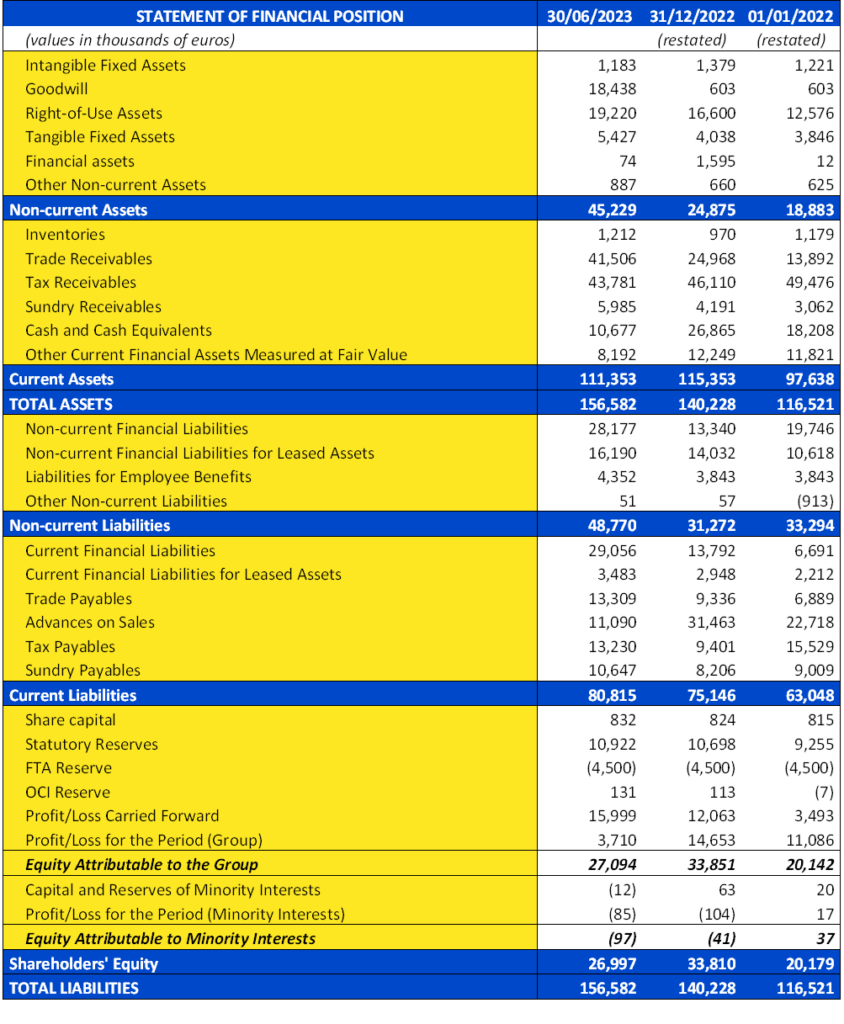

STATEMENT OF FINANCIAL POSITION (in thousands of euros)

| RECLASSIFIED STATEMENT OF FINANCIAL POSITION | 30/06/2023 | 31/12/2022 |

| Inventories | 1,212 | 970 |

| Trade receivables | 41,506 | 24,968 |

| Trade payables | (13,309) | (9,336) |

| Operational NWC | 29,409 | 16,602 |

| Other current receivables | 49,766 | 50,301 |

| Taxes payable | (13,230) | (9,401) |

| Other current payables | (21,737) | (39,669) |

| Net Working Capital | 44,208 | 17,833 |

| Tangible fixed assets (including rights of use) | 24,647 | 20,638 |

| Intangible fixed assets (including goodwill) | 19,621 | 1,982 |

| Financial assets | 74 | 1,595 |

| Fixed assets | 44,342 | 24,215 |

| Other non-current assets | 887 | 660 |

| Other non-current liabilities | (50) | (57) |

| Net Invested Capital | 89,387 | 42,651 |

| Shareholders’ Equity | 26,997 | 33,810 |

| Cash and cash equivalents | 10,677 | 26,865 |

| Current Financial Receivables | 8,192 | 12,249 |

| Current financial liabilities | (32,539) | (16,740) |

| Non-current financial liabilities | (44,367) | (27,372) |

| Net Financial Position | (58,037) | (4,998) |

| Shareholders’ Equity and Net Financial Debt | 85,034 | 38,808 |

| Short-term Financial Position | (13,670) | 22,373 |

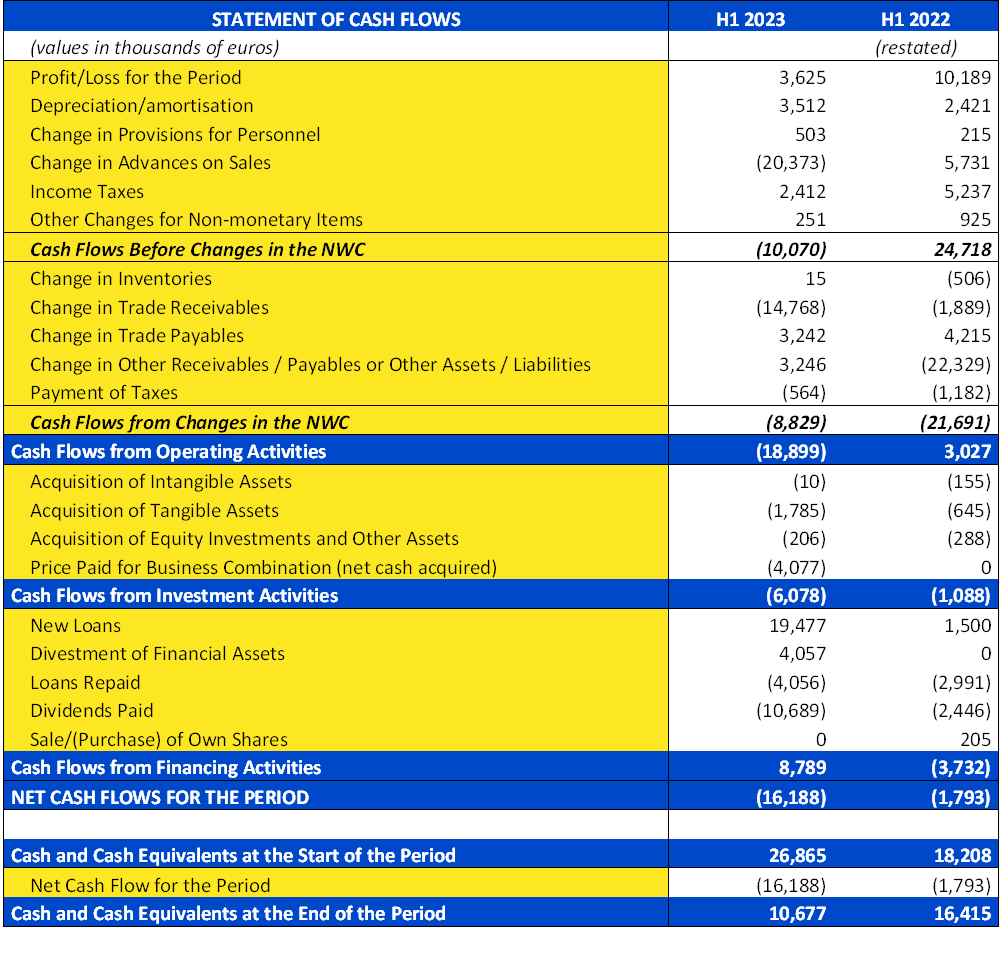

The international IAS standards use different criteria than the Italian standards, which meant that the net financial position as at 30 June 2022 was recalculated from 6.8 million (positive) to 5 million (negative). With the same criteria, the consolidated net financial position as at 30 June 2023 was calculated at €58 million in 2023 (negative). This change is due to the return to normal operations unrelated to the tax breaks ended in February 2023, the payment of dividends of approximately €11 million, the inclusion of debt for leased assets of €20 million, investments including the purchase of 51% of Enigma Capital Investments LLC equal to €5 million and the option to purchase the remaining 49% equal to approximately €13 million, and finally the increase in Acrobatica Energy’s debt position due to the significant increase in turnover from €1.3 million to approximately €16 million.

OUTLOOK FOR THE CURRENT YEAR

We believe that with the 50% growth in the number of new contracts signed by EDAC customers in H1 2023 despite the interruption of tax subsidies in February 2023, the 2023 financial year will end with positive growth. In terms of quantity, the contracts signed at the Group level in the first half of last year amounted to more than 7,700, increasing to more than 11,500 in the same period of 2023 resulting in a significant surge in the number of active customers, demonstrating the company’s great ability to penetrate the market.

Interesting opportunities in the area of real estate maintenance and energy efficiency are being evaluated, in relation to which the Council of the European Union in July 2023 adopted a new directive that aims to reduce final energy consumption at the European level by 11.7% by 2030, in the context of which national contributions and trajectories will be established for the achievement of the objective in the respective integrated national energy and climate plans (NECPs) to be defined by 2024.

The implementation of the new Oracle ERP management system began at the beginning of 2023, requiring a significant effort in terms of human and financial resources, and will continue throughout 2023 in order to provide all the Group’s companies with a cutting-edge technological IT environment. Investments in marketing continue, including advertising campaigns on national television stations aimed at further reinforcing the value of the brand for the final consumer, in addition to the continuation of the contract as back-sponsor on the Torino FC shirts for the current Serie A football season, and the Main Partner contract with the Torino FC Women’s First Team. Furthermore, starting in 2023 EdilziAcrobatica became a sponsor of Martina Trevisan, the Number 1 tennis player in Italy and Number 18 in the world, and Alberto Riva, the young sailing champion and technical partner of Correnti Srl. In 2023 the Acrobatica Sailing Team was born, the three-year project thanks to which “Acrobatica” was christened: a Class40 completely made in Italy and equipped with latest-generation navigation systems that will accompany the young sailor during the Transat Jacques Vabre, the ocean crossing that will begin in October 2023, and for all his next adventures in the three years of 2023 to 2026.

The plan also continued to strengthen the centralised functions responsible for providing support to both the direct Italian operating offices and franchisees, as well as to the subsidiaries in order to build a corporate structure that is robust, flexible and adequate to the requirements of a listed company, while complying with the principles of efficiency and cost containment.

EdiliziAcrobatica is thus pursuing its growth strategy, opening new offices in Italy and continuing its expansion abroad. Between 30 June 2022 and 30 June 2023 direct offices in Italy increased by 13 units, from 80 to 93 offices.

During the recent crisis the Group was able to demonstrate that it is resilient and able to seize the opportunities that arise even in difficult times, like the conflict in Ukraine. In this regard, EDAC management is continuing to monitor any critical issues and impacts on the Group, potential or otherwise, developing alternative scenarios for increases in the prices of raw materials, transport and fuel. As far as credit risk is concerned, there are no positions opened directly with Russian or Ukrainian counterparties. The Group enjoys good financial stability, and therefore there have been no significant or noticeable impacts on the Group’s operations due to the current state of the crisis.

Finally, it should be noted that the performance of the first six months of the 2022 financial year was well beyond the best expectations and the results of H1 2023 are more in line with the trend of H2 2022. The national subsidies that it benefited from between 2020 and 2022 ceased at the beginning of 2023, and the impact of this interruption was largely absorbed in the subsequent first half of the year.

Based on the above and thanks to its organisational flexibility as well as its solid financial situation, the Group intends to continue its growth strategy, opening new offices in Italy on the one hand and continuing its expansion abroad on the other.

***

DOCUMENTATION FILING

The documentation relating to the Half-Yearly Report as at 30 June 2023, required by current regulations, will be made available to the public at the registered office (Via Turati 29, 20121 Milan) as well as through publication on the institutional website www.ediliziacrobatica.com, “Investor Relations/Financial Documents” section.

Annexes:

• Consolidated profit and loss statement as at 30/06/2023

• Consolidated statement of financial position as at 30/06/2023

• Consolidated statement of cash flows as at 30/06/2023

This press release is available online at www.1info.it and on the Issuer’s website at www.ediliziacrobatica.com (Investor Relations / Press Releases section).

***

EdiliziAcrobatica S.p.A. is the leading company in the exterior renovation sector. Founded in Genoa in 1994 by Riccardo Iovino, the company now has around 2,300 employees and more than 130 operating areas in Italy, France, Spain, the Principality of Monaco and the United Arab Emirates. The double safety rope technique it employs allows working without scaffolding or aerial platforms, thus offering end customers a quality service and the elimination of scaffolding costs. Listed on the Euronext Growth Milan market since November 2018 and on the Euronext Growth Paris market since February 2019, ACROBATICA has integrated the principles of sustainability into its Business Model, guaranteeing a naturally sustainable service and a responsible approach that pursues the well-being and satisfaction of its internal and external stakeholders, and in 2022 it earned an ESG Rating that places it among the lowest-risk companies in its cluster of reference.

For info: www.ediliziacrobatica.com

| Group Investor Relator EdiliziAcrobatica S.p.A. Martina Pegazzano investor.relator@acrobaticagroup.com C: +39 342 0392683 | Press Office Manager EdiliziAcrobatica S.p.A. Deborah Dirani ufficiostampa@ediliziacrobatica.com C: +39 393 8911364 |

| Financial Press Office Close to Media Davide Di Battista davide.dibattista@closetomedia.it Enrico Bandini enrico.bandini@closetomedia.it | Euronext Growth Advisor Banca Profilo S.p.A. Via Cerva 28 – 20122 Milan ediliziacrobatica@bancaprofilo.it Tel. +39 02 584081 |